Grain Snippets: Lentils Light the Way for Christmas

Lentil markets have continued to drive higher over the past fortnight, with delivered Adelaide bids hitting $610/MT for NIPT1 late last week, now $100/MT above where we saw the most recent lows in August/September. Growers have remained cautious with sales; particularly as lofty prices have remained intact for more than 3 trading sessions with strong competition amongst buyers at the top bids. Market volatility has been exacerbated as traders scrambled to cover forward commitments whilst growers continue to hold onto new crop supply. Even system tonnes are attracting good prices with upcountry bids reaching $590/MT for all lentil varieties. Current market drivers consist of;

- A lacklustre SA Lentil crop

- Limited grower selling

- Potential trade short covering

- Stronger exports from Australia and Canada

- Tightening in the Indian pulse balance sheet

- Increases in Indian food inflation, now the highest level since December 2013

- Delays in the Kharif harvest and Rabi pulse planting due to extended monsoon season

- Increased chance that Indian government may review pulse import duties

Australian Exports Rising

Australia’s lentil exports for the month of September showed modest gains, up 14% from the previous month. Current ABS trade statistics reported Bangladesh was the biggest importer; India was the second most important destination, followed by Sri Lanka. Subsequently, we have seen the increase in export demand push prices higher recently. Overall, since the beginning of the marketing year, shipments are still lower relative to the five-year average, by 14%.

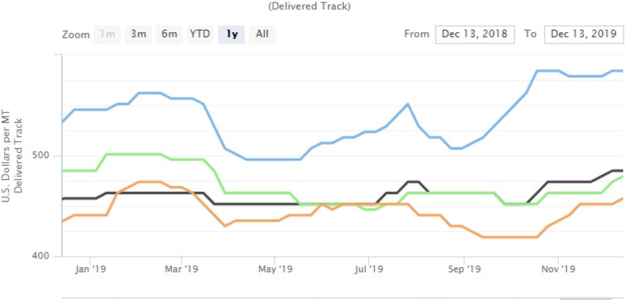

Canadian Lentil Prices on the Rise

Our biggest lentil export competitor, Canada, was expecting a rise in production by 20% to 2.5MMT this year due to higher anticipated yields; however, a report released last week has revised production lower to just 2.17MMT, a rise of only 3.6%. This was mainly due to unfavourable weather conditions, hampering quality and harvest progress. That said, overall supply is still expected to increase mildly despite lower carry-in stocks compared to previous years. There have also been some concerns about the quality of this year’s Canadian lentil harvest after a large percentage of the crop was hit by frost, snow, and rain. Consequently, many tonnes may be diverted into livestock feed as quality will not meet human consumption standards. Regardless of this, bulk export shipments are up 77% for the season to-date with increased demand from India, Bangladesh and Turkey. With the current export pace, we anticipate that exports could rise roughly 5% on initial estimates, which would help draw ending stocks even lower. Should this occur, it is likely that total usage could reach 2.52MMT, leaving ending stocks at a mere 340,000MT. This would imply a stocks to use ratio of just 13.5%, down from 27.7% last year. Although we have seen an increase in exports out of Canada, red lentil prices have only risen USD$35/MT since late September.

Tightening Indian Balance Sheet

After more than two years of low prices exacerbated by burdensome stocks that hurt growers’ interests and forced the Indian government to establish price support policies, the Indian pulse market is gradually moving towards what can be described as a ‘balanced market’. Rising from their lows, prices of major Indian produced pulses are finally testing their specified minimum support price (MSP). Other noteworthy developments in India include food inflation rising to its highest level since December 2013. Currently at 10.01% year on year, what is surprising, is the rate that it has increased at considering it was just 2.99% in August. Food inflation significantly impacts households in India and subsequently we may see further exports to India in order to minimise the impact of a spike in food prices. The increase has been attributed to Kharif crop damage from excess and unseasonal rains.

There are concerns regarding the fate of the 2019/20 Kharif crop that has now finished being harvested. Pigeon Peas, urad, and mung beans are the main pulses crops for Kharif season. These have been planted on 13.4 million hectares, nearly the same as last year’s crop. Indian production is likely to be lower year on year as final yields of the Kharif crop were reduced and harvest delayed as late monsoonal rains impacted the crop. This expected damage to pulse crops which is being observed in western and central India has been a key reason why Indian prices have skyrocketed. Initial production estimates had the crop pegged 10.1MMT for 19/20, however, this has since been reduced to just 8.23MMT (down 18.5 % on target).

The Rabi crop has also felt the impacts of the late monsoon with delays to sowing, currently down 8.6% compared to the same time last year. As of December 6th, India’s farmers had planted 10.52 million hectares of pulses, down from 11.19 million at the same time last year. Overall, current estimates have the Indian pulse crop down 4% year on year, but lentil production looks to be estimated slightly higher than the 18/19 season at 1.57MMT vs. 1.55MMT. Despite the delay in planting progress, good soil moisture will aid in boosting lentil crop prospects into early next year.

Indian Pulse Imports on the Rise

While chickpeas are India’s largest pulse crop grown in the Rabi season (harvested in March/ April), Pigeon Peas are the major pulse crop of the Kharif season (harvested in October/November). Together, these two pulses account for 60% of the country’s aggregate pulse production. The price increases seen in these two commodities is having a flow on effect of positively lifting the demand and prices of other pulse crops (including lentils). India’s lentil imports are on the rise and are up strongly on last year. Despite quantitative and tariff restrictions, India continues to import various pulses. It is estimated that during the first six months (April to September) of the new 2019/20 financial year, at least 1.1MMT of various pulses have entered the country. Lentils (350,000 tonnes) were the second largest imported pulse commodity behind yellow peas.

Pulses are among the most economical source of vegetable protein in India and as India slips further down the Global Hunger Index, it appears government controls on pulses are not working in the way they anticipated. As inventory with traders begins to lighten, there is widespread expectation of a directional change in Indian pulse market prices, and the change points upwards. In the coming months, New Delhi may well reconsider the existing import restrictions and possibly loosen them, if not fully eliminate them.

SA Bean Prices

Generally, grain markets have been finding some strength over the past month and Faba beans have been no exception. Values have been pushing higher throughout this period and currently sit at $585/MT delivered Adelaide packer. This is an increase from around $500/MT where it bottomed early harvest. The fact that this price strength has occurred throughout harvest due to a lack of liquidity from the grower’s end being the main driver for the recent strength. With areas north of Adelaide having a below average year on the beans, buyers have been forced to wait until the south east gets underway in order to secure significant tonnes. This lack of buying through early harvest due to the poor crop in central and northern areas has seen traders get itchy feet and subsequently the market has rallied. The main concern moving forward, is that the south east harvest is well underway, and we may see some grower selling which could put some pressure on the market. Growers should wait until the current upward trend begins to consolidate before making further bean sales.

This is a sample only, if you would like to view the entire document and our recommendations, please contact CloudBreak to discuss becoming a member on (08) 8388 8084